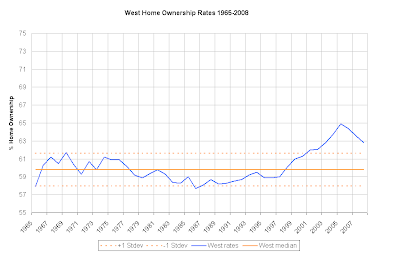

I recently came across some home ownership data that was interesting in context of how it fits into the current bubble and what its potential long term consequences are. It appears that most of the US has historically been within +/- 1 standard deviation of the median home ownership rates for 30+ years, before the current housing bubble began.Click on any of the following charts to enlarge them

Northeast: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont, New Jersey, New York, Pennsylvania.

Midwest: Illinois, Indiana, Michigan, Ohio, Wisconsin, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota.

South: Delaware, District of Columbia, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, West Virginia, Alabama, Kentucky, Mississippi, Tennessee, Arkansas, Louisiana, Oklahoma, Texas.

West: Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming, Alaska, California, Hawaii, Oregon, Washington.

Homeownership Rates. The proportion of households that are owners

Per 2006 census data (

Source) there are 77,402,000 households in the US. The median US home ownership rate is 64.7% and the current rate is ( 1Q08) is 67.8%. A reversion to historic home ownership rates would require that 1.1 million to 3.7 million homeowners become renters, with the long term median requiring about 2.4 million homeowners to revert to renting.

For reference, there is an average of 3.9 people per household per the 06 census data.

A second bit of data I found from the same source was historical data of Asking Sale Price and Rental Prices, both nationally and regionally. The following chart shows the ratio of Asking Sales price Vs Rental Price for the Northeast and the nation.

This small set of data alone should be enough to illustrate that we will not see a recovery of the housing market anywhere in the near future. It also suggests that the northeast is still in line for a substantial correction. We have seen an approximate increase of 62% in the Northeast Asking Sales prices VS Rental price ratio in just the last 4 years when for the previous decade that ratio was staying in the neighborhood of 200.

This is also bad news for the recent buyers who bought with a plan of turning a profit on rental properties or who hope to rent their home out to cover the expense that they may not be able to afford. This last chart shows that both rents and home prices are set for a drop. While there will be some segment of the landlord population that is still positioned to profit, this will become a very tough market in the near future as their are